Data insights: Early April spikes in EBT theft

Summary

Propel detected significant spikes in EBT theft in several states in early April 2025. While overall theft rates have declined since January, these spikes warrant immediate attention.

Propel monitors customer-reported EBT theft in real-time, allowing us to detect fraudulent patterns as they emerge. While EBT theft in Q1 2025 decreased from unprecedented levels seen in Q4 2024, we continue to observe extremely high levels of EBT theft overall.

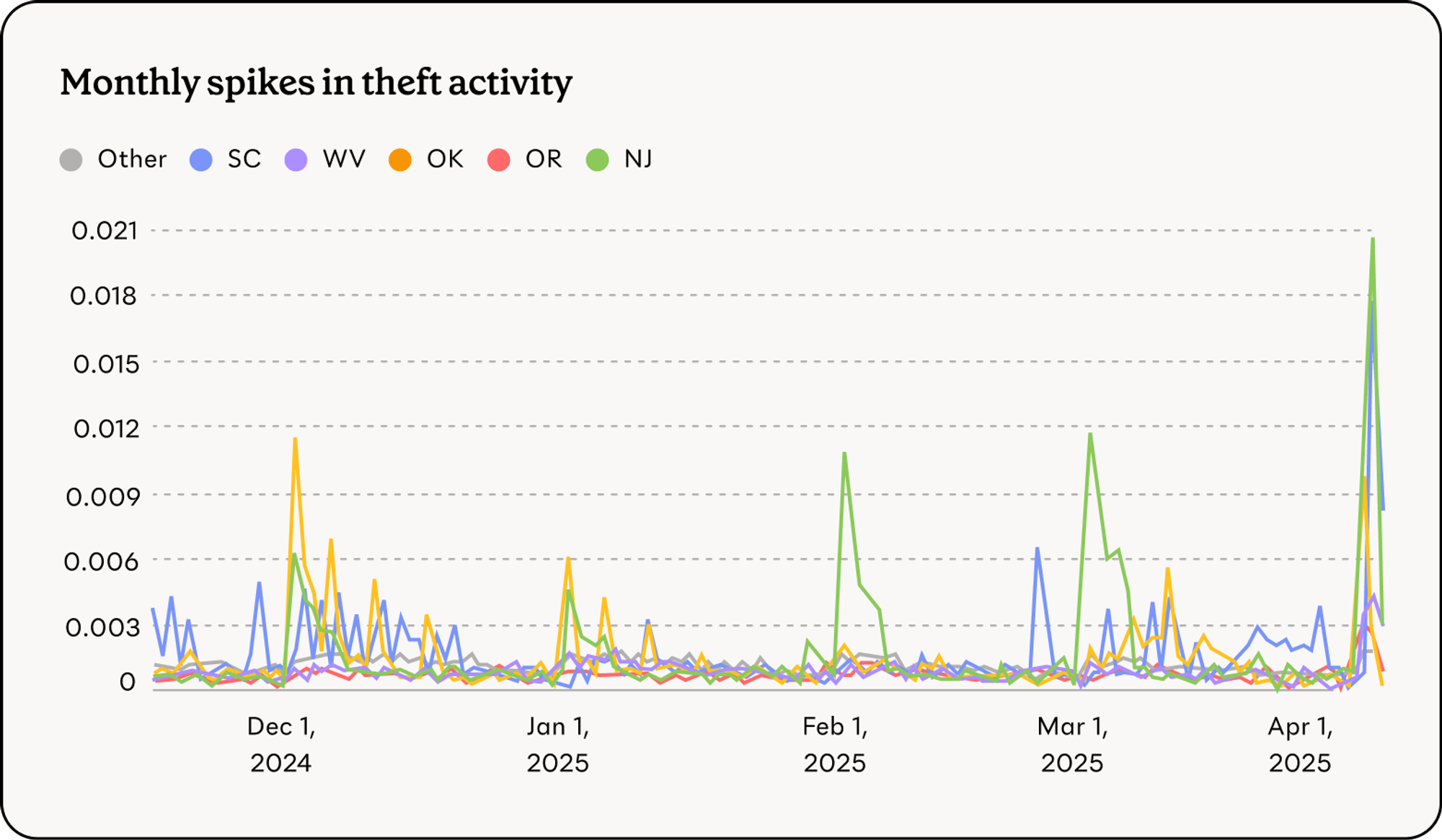

We also see spikes in theft activity at the beginning of each month, with the most impacted states changing over time. April's most troubling patterns appeared in New Jersey, where skimming attacks were concentrated, and South Carolina and Oklahoma, which are experiencing state-level effects. These distinct patterns suggest criminals are using different methods to steal benefits across different states.

Background: How we detect fraud#background-how-we-detect-fraud

Propel serves over 5 million EBT cardholders nationwide who use our app at least monthly to manage their benefits. Our unique position allows us to gather and analyze data that reveal fraud patterns in close to real time.

Our two-step fraud detection process includes:

- Finding liquidators: We identify retailers with unusually high rates of transactions flagged as "unrecognized" by Propel users. These are stores where stolen benefits are being spent.

- Finding skimmers: We then analyze where victims shopped in the 6-8 weeks before their benefits were stolen, looking for patterns that reveal where card information was likely compromised.

2025 data trends to date#2025-data-trends-to-date

Our data shows a gradual decline in overall theft rates in recent months, but the overall levels remain high. The decline in theft rates appears to be driven mostly by reductions in Georgia, Alabama and Arkansas, which had extremely high theft rates in fall 2024 and into early 2025. By March, Virginia and Utah were seeing the highest rates of unrecognized transactions.

Table 1. States with highest rates of unrecognized transactions, by month

| Rank | Jan 2025 | Feb 2025 | Mar 2025 |

|---|---|---|---|

| 1 | GA (0.63%) | GA (0.36%) | VA (0.23%) |

| 2 | AR (0.31%) | AR (0.25%) | UT (0.23%) |

| 3 | AL (0.28%) | AL (0.23%) | GA (0.21%) |

| 4 | VA (0.23%) | PA (0.23%) | NJ (0.20%) |

| 5 | IN (0.21%) | VA (0.20%) | AL (0.18%) |

| 6 | PA (0.20%) | CT (0.19%) | RI (0.16%) |

| 7 | DE (0.18%) | IN (0.19%) | AR (0.16%) |

| 8 | CT (0.16%) | NJ (0.18%) | OK (0.16%) |

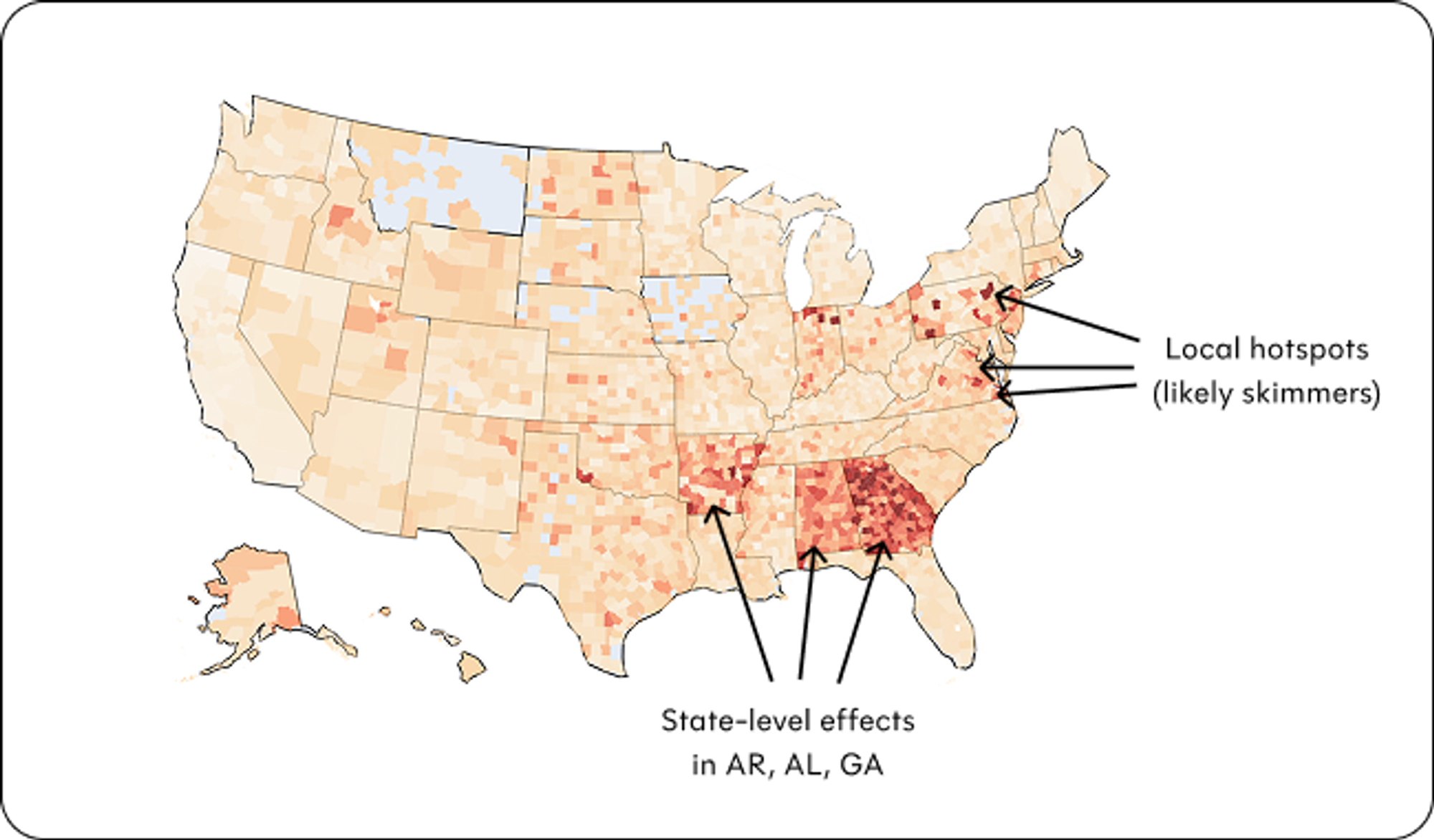

Our data also reveals two distinct patterns of theft: skimming activity in local hotspots (eg, Virginia and Pennsylvania), and fraudulent activity that spans entire states (eg, Arkansas, Alabama, and Georgia).

Early April spikes#early-april-spikes

Liquidation activity is typically highest at the beginning of each month, immediately after many SNAP participants receive their benefit deposits. While overall theft has declined since January, we detected spikes in early April in several states. Below are detailed analyses of the three most notable states.

New Jersey

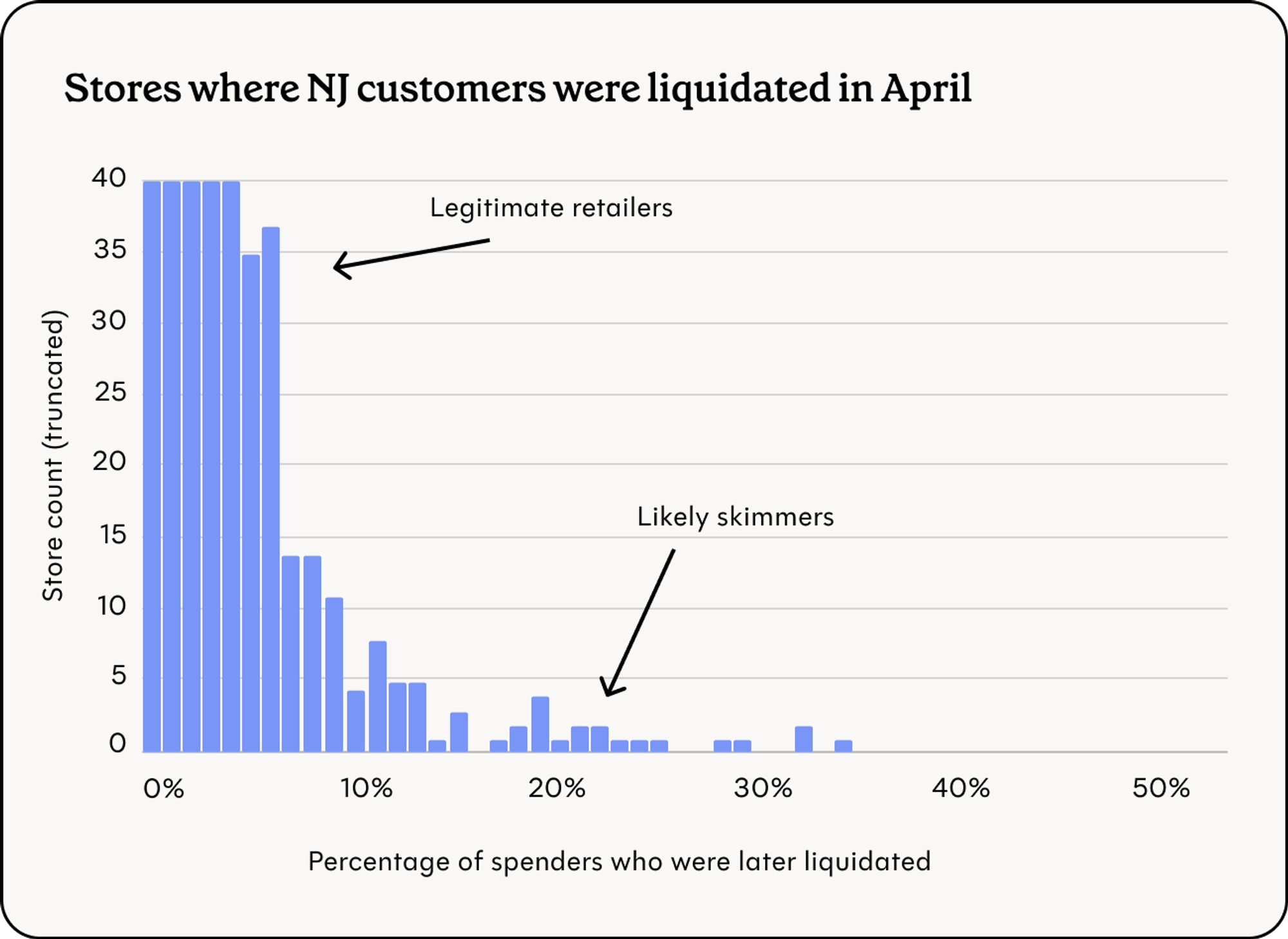

New Jersey shows clear evidence of skimming. At some retailers, over a fifth of March customers were subsequently liquidated in early April, suggesting the presence of skimmers rather than legitimate benefit redemption. Our analysis of transaction patterns and customer reports suggest that these retailers are located across Chicago, New York, and Philadelphia.

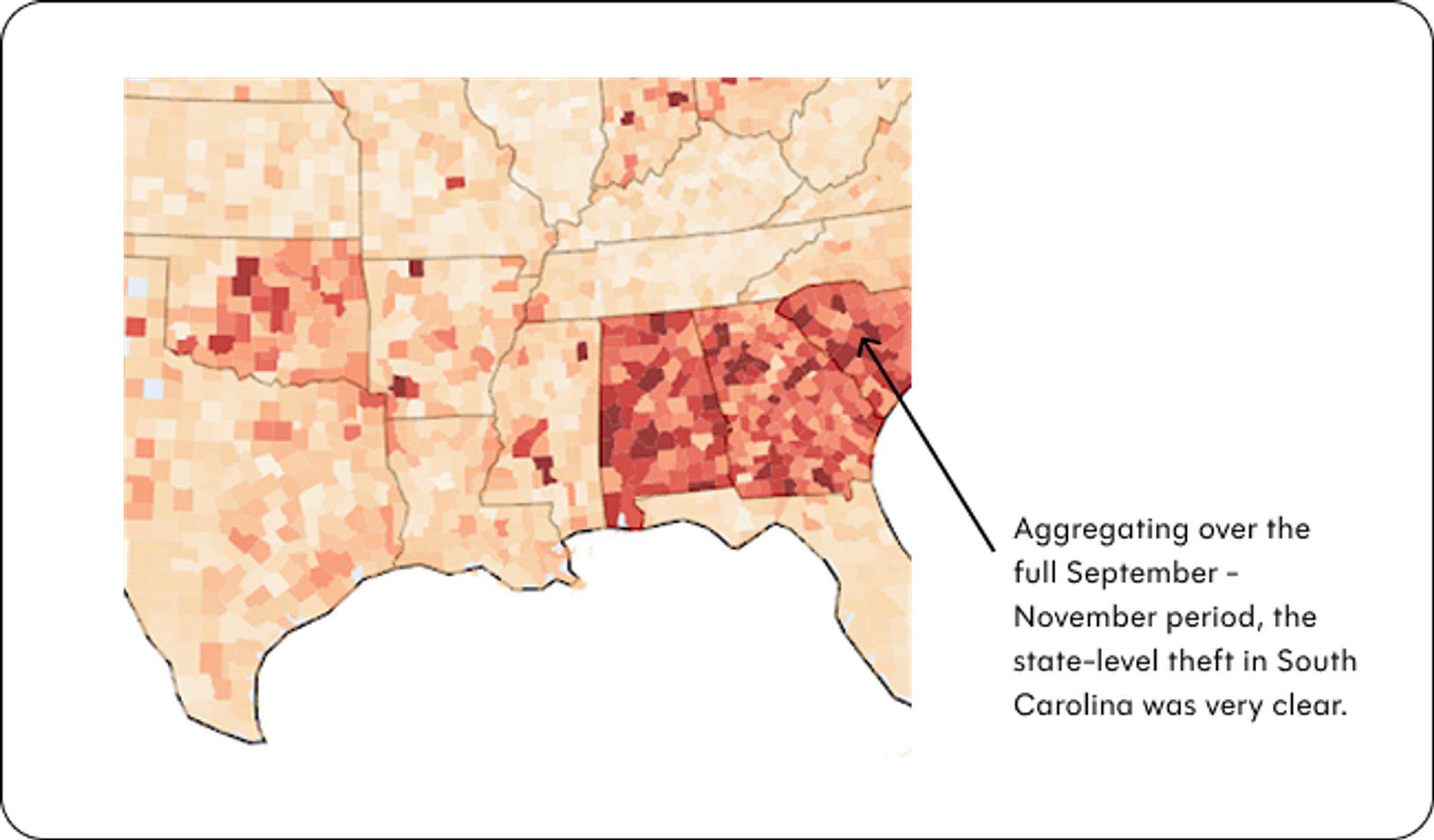

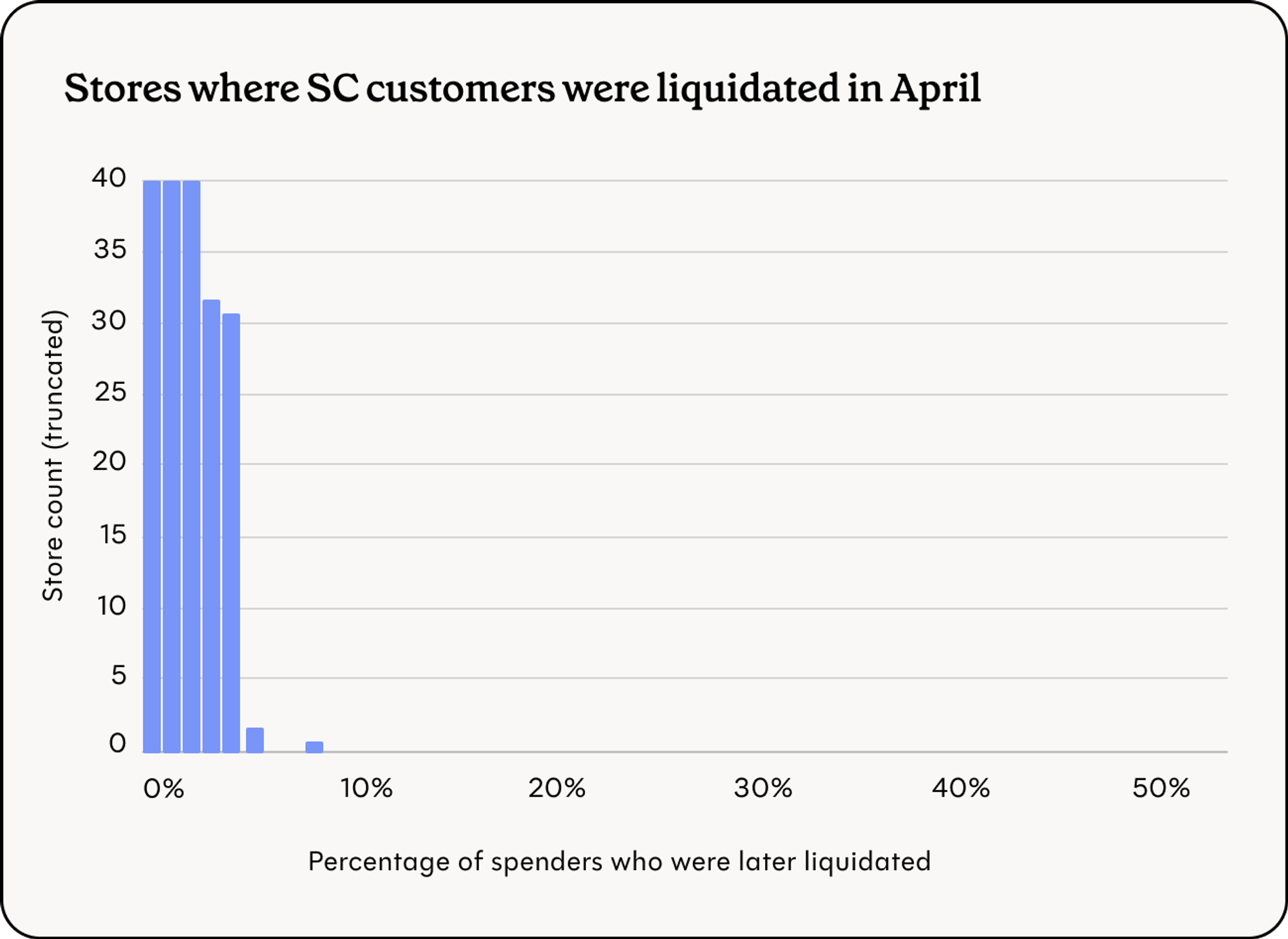

South Carolina

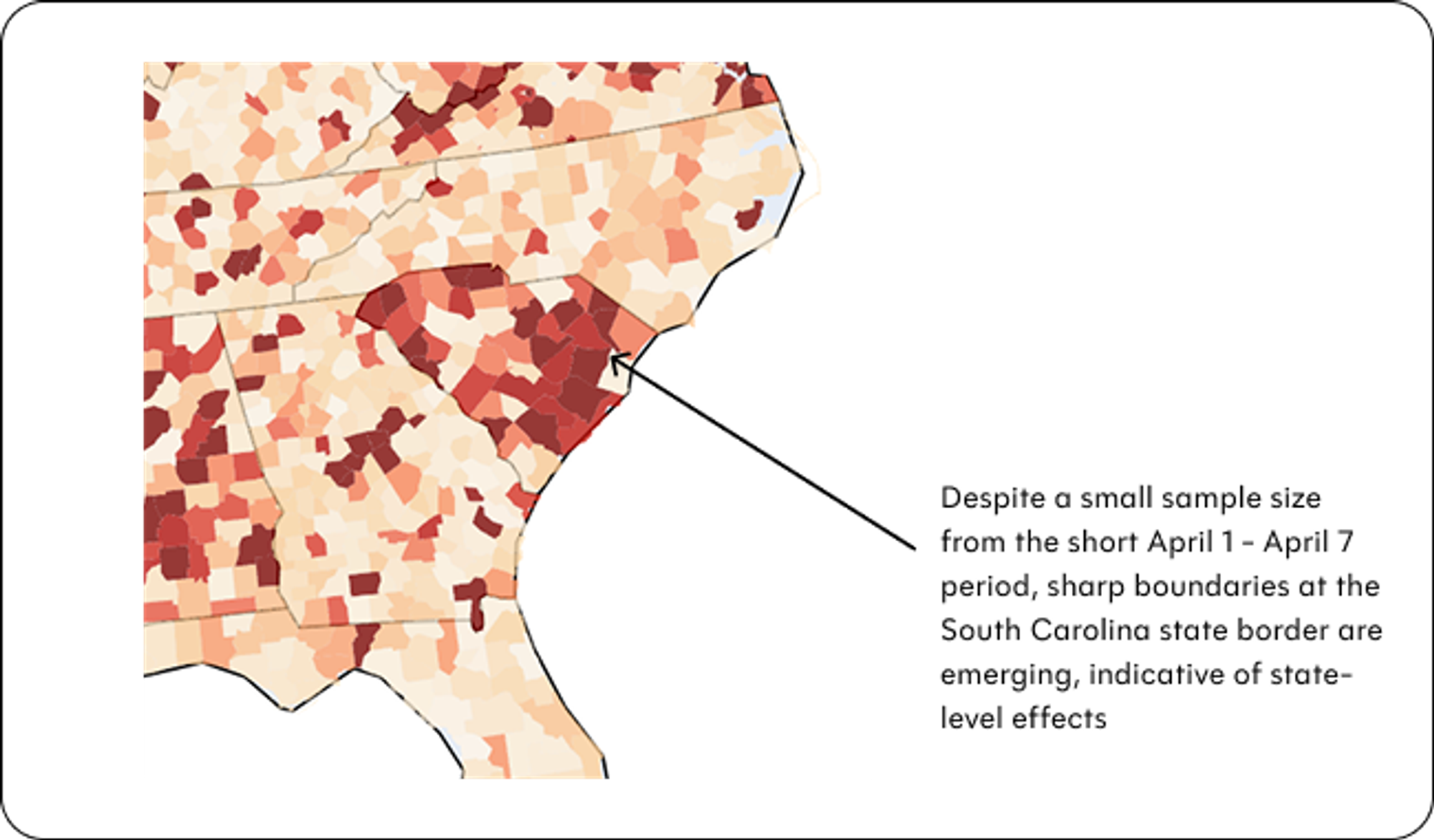

Sharp boundaries emerging at the South Carolina state border in our most recent data analysis suggests a different vector of EBT theft, one that is not tied to skimmers. We saw a similar pattern in fall 2024.

Unlike New Jersey, South Carolina is not experiencing concentrated skimming at identifiable retailers.

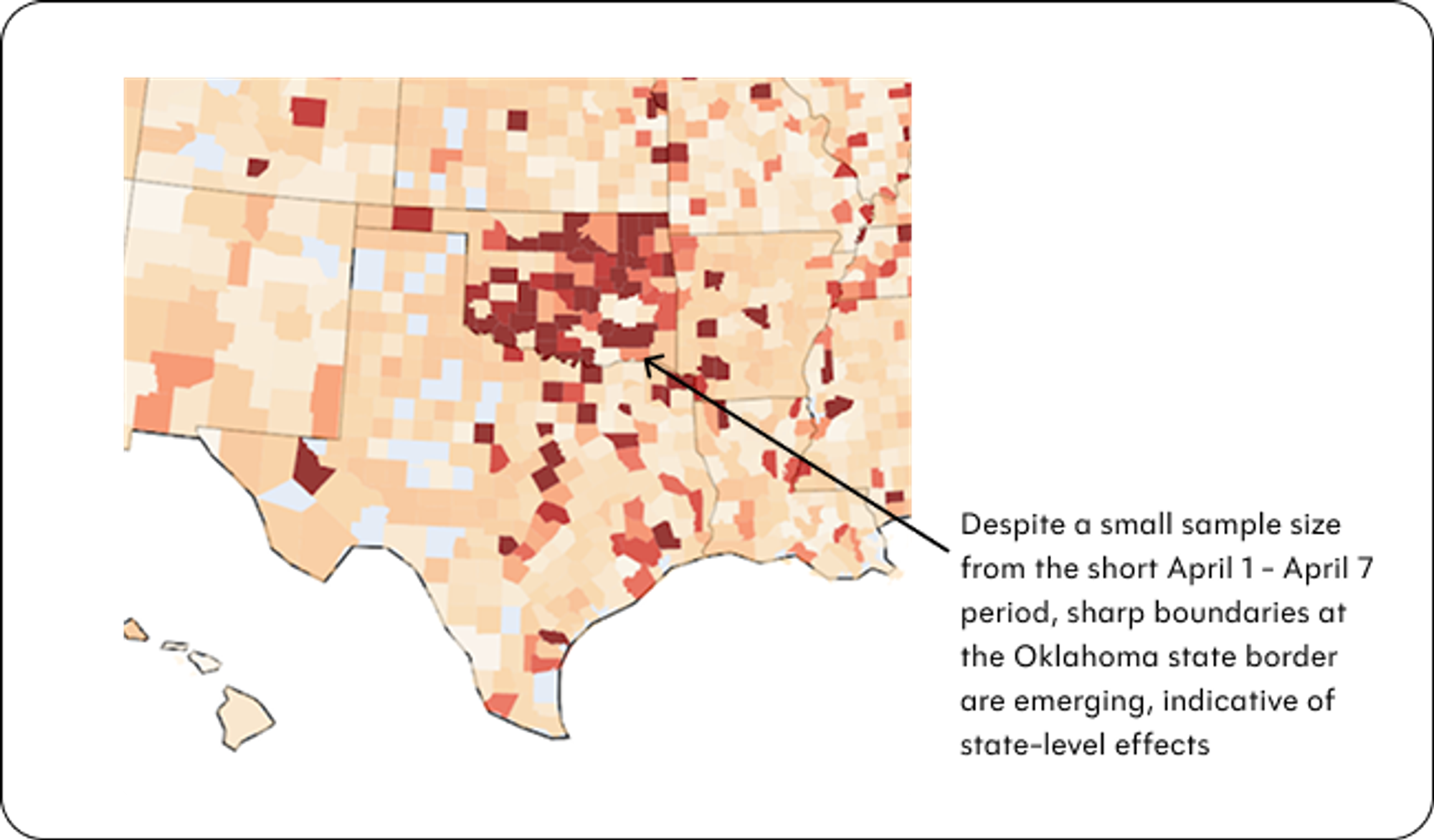

Oklahoma

Oklahoma shows patterns similar to South Carolina: clearly defined state boundaries emerge when customer reports of unrecognized transactions are mapped. This indicates a potential coordinated attack on state-level systems.

Implications & recommended actions#implications-and-recommended-actions

This data reveals coordinated fraudulent operations targeting SNAP recipients through different mechanisms. The patterns emerging in early April may warrant:

- Alerts to affected areas. Warn SNAP recipients in the identified states, particularly New Jersey, South Carolina, and Oklahoma, about the heightened risk. Propel can contact cardholders who use the Propel app.

- Differentiated response strategies. In New Jersey, focus on physical inspection of POS devices at suspicious retailers. In South Carolina and Oklahoma, investigate potential statewide vulnerabilities.

- Law enforcement coordination. This data offers actionable intelligence for targeted investigations of both specific retailers in New Jersey and statewide systems in South Carolina and Oklahoma.

- Ongoing monitoring. Propel can provide updates as patterns shift or new hotspots emerge.

Next steps#next-steps

Propel is committed to supporting state and federal agencies in protecting SNAP recipients from EBT theft. For questions about our methodology or further analysis, please reach out.